Projects for Fun

REIT Acquisition Analysis

•3 min read

finance

excel

real-estate

modeling

REIT Acquisition Analysis

I built an Excel model to underwrite the acquisition of an 80-unit residential property as part of a REIT portfolio to show simple scenario based analysis. The model evaluates pricing, forecasts operating performance, and tests return scenarios over a 10-year hold.

| Asset Details | |

|---|---|

| Community Name | West Ridge North |

| Units | 80 |

| Year Built | 1994 |

| Last Remodeled | N/A |

| Seller | Birch Tree Mgmt |

| Acquisition Details | |

|---|---|

| Purchase Price | $7,288,683 |

| Cap Rate | 6.00% |

| Cost Basis | $9,288,683 |

| Holding Period | 10 years |

| Exit Cap Rate | 6.00% |

| Operational Assumptions | |

|---|---|

| Cost Growth % | 4.00% |

| Rent Growth % | 2.00% |

| Sale Details | |

|---|---|

| Sale Price | $17,309,612 |

Download Excel File Download Excel File

Excel Concepts Covered

- Custom number formatting (e.g. period labels with “Year 1”)

HLOOKUP,INDEX+MATCHfor pulling NOI by year- Sensitivity tables to test exit cap rates and occupancy

- Linking assumptions to dynamic cash flow and valuation outputs

Model Assumptions

- Property: 80 units, built 1994, purchase price $7.3M (6% cap)

- Operational: 2% annual rent growth, 4% annual cost growth

- Occupancy/Delinquency: 80% occupancy, delinquency declining from 12% → 5%

- Renovations: $2M in Year 2

- Sale: 10-year hold, 6% exit cap, projected sale ~$17.3M

Highlights

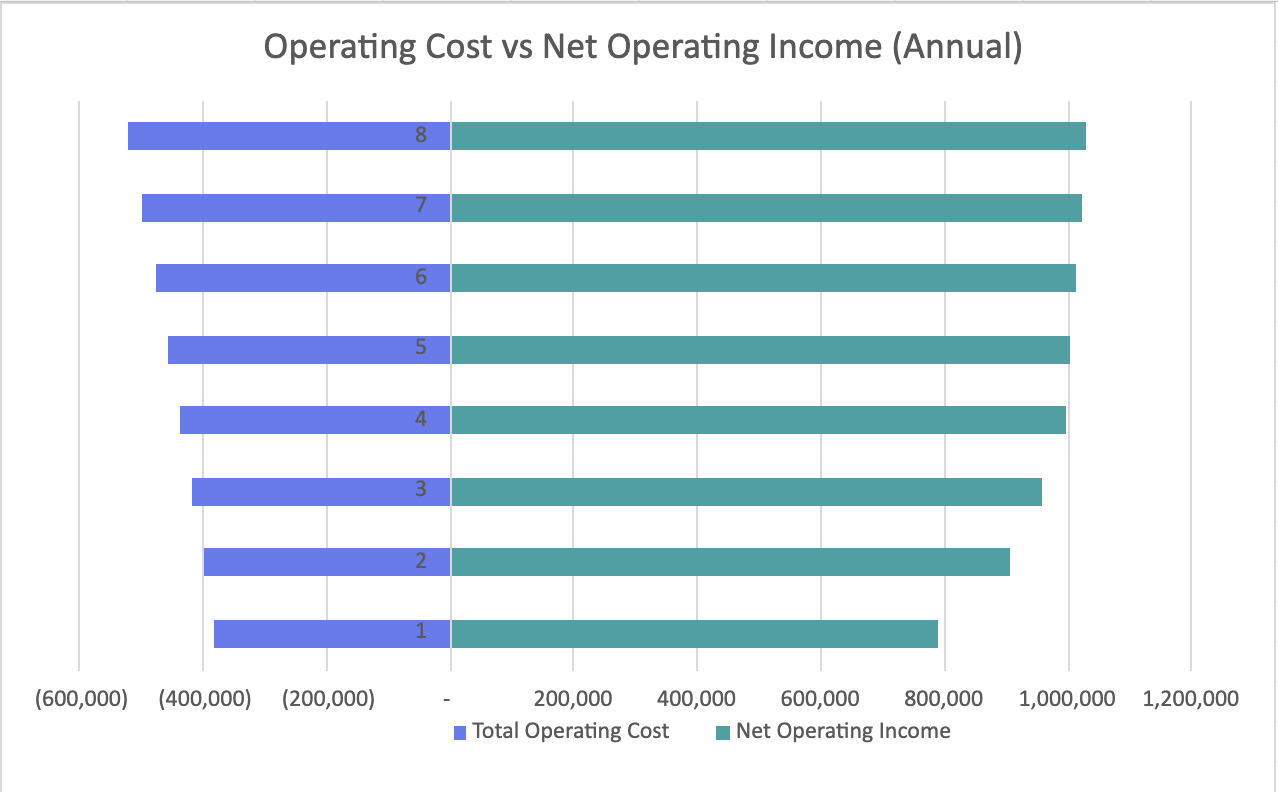

- Year 10 NOI: ~$1.04M (2.4× growth)

- Total invested capital: $9.3M

- Projected sale price: ~$17.3M

- Equity multiple: ~1.9×

- IRR: mid-to-high single digits

Key Takeaways

- Renovations reduce near-term net income but support long-term NOI and higher exit value.

- Returns are always measured against total invested capital (purchase + CapEx), not just the purchase price.

- The purchase price is not amortized in investment modeling — unlike GAAP accounting depreciation — because investors focus on cash returns (dividends + sale proceeds), not paper net income.

- Sale price and IRR are highly sensitive to assumptions about occupancy, delinquency, and exit cap rate.

This project demonstrates Excel modeling, real estate underwriting, and scenario analysis in the context of REIT acquisitions.